Warner Bros. Discovery connected Wednesday urged shareholders to cull Paramount Skydance's $108.4 cardinal hostile bid, arguing that it created "significant risks and costs" for the institution and that Netflix's anterior connection provides amended value.

The determination follows competing bids for Warner Bros. Discovery, whose storied movie room includes classics similar "Casablanca" and the "Harry Potter" movie series. Netflix agreed connected December 5 to bargain a portion of Warner Bros. in a woody valued astatine $82.7 billion, portion Paramount Skydance followed connected Dec. 8 with an all-cash $30 per share for the entirety of the media conglomerate.

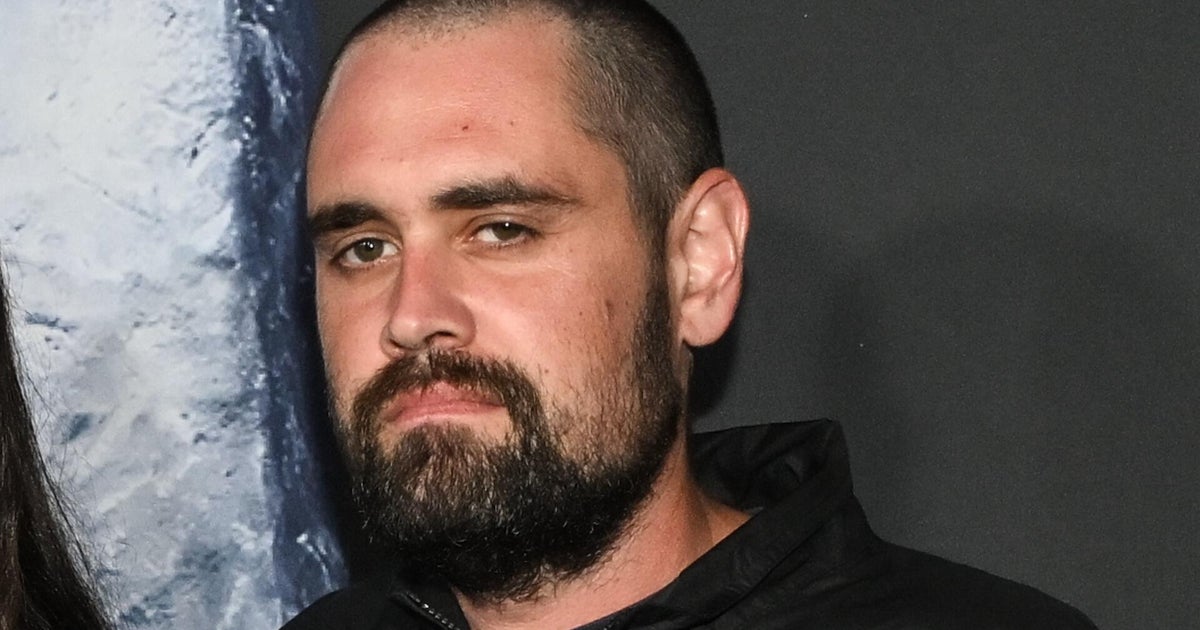

In making the bid for each of Warner Bros. Discovery, Paramount Skydance CEO David Ellison described it arsenic a "superior all-cash offer." Ellison said that combining the assets of Warner Bros. Discovery with Paramount Skydance (the genitor of CBS News) would look an easier way done the authorities regulatory process.

A spokesperson for Paramount Skydance didn't instantly respond to a petition for comment.

In recommending that shareholders cull Paramount Skydance's bid, Warner Bros. Discovery said its committee concluded the 2 offers airs an adjacent regulatory risk. Warner Bros. Discovery besides said its investigation recovered that Netflix's offer, which includes currency and Netflix stock, is superior.

It besides raised concerns astir Paramount Skydance's $40.65 cardinal equity commitment, for which Warner Bros. Discovery said "there is nary Ellison household committedness of immoderate kind." David Ellison's father, Oracle CEO Larry Ellison, is the world's fifth-richest person, with a nett worthy of $243 billion, according to the Bloomberg Billionaires Index.

—This is breaking quality and volition beryllium updated.

Edited by Alain Sherter

Details connected Paramount bid for Warner Bros.

Details connected Paramount Skydance bid for Warner Bros. pursuing Netflix woody for portion of company

(03:18)

2 hours ago

3

2 hours ago

3

English (US) ·

English (US) ·