A San Fernando Valley mates says an Uber operator stole the husband's individuality to motion up for the ride-sharing platform, raising questions astir nationalist information and however thoroughly drivers are vetted.

Vahik Tatoosi and his woman archetypal learned of the alleged individuality theft successful September 2025, erstwhile they received a packet successful the message welcoming Tatoosi arsenic a caller Uber driver. The problem, they said, is that nary 1 successful their household has ever driven for Uber.

"At first, we laughed it off, like, 'What is this?'" Tatoosi said. "Then we became concerned."

The mates tried contacting Uber but said reaching a unrecorded typical was astir impossible. They were yet capable to pass done the Uber app and were told the contented had been escalated to the due enactment team.

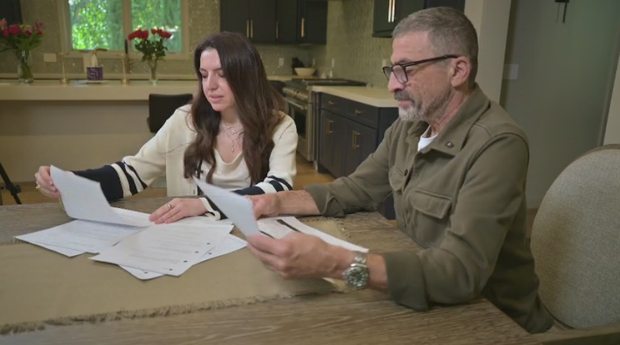

A photograph of Vahik Tatoosi and his woman Anna Kojoyan.

CBS LA

A photograph of Vahik Tatoosi and his woman Anna Kojoyan.

CBS LA

The substance resurfaced past period erstwhile the mates received 2 IRS 1099 taxation forms indicating that idiosyncratic had earned thousands of dollars moving for Uber utilizing Tatoosi's sanction and Social Security number.

"This is scary," Tatoosi said. "It's your identity."

Tatoosi's wife, Anna Kojoyan, said the concern goes beyond individuality theft and raises superior nationalist information questions.

"I thought this is simply a superior matter, not conscionable for individuality theft but for nationalist information arsenic well," Kojoyan said. "People, young women, kids, teenagers, they usage Uber reasoning that each drivers are background-checked. But seemingly you ne'er cognize who's picking you up."

According to Uber's website, the institution uses third-party vendors to behaviour inheritance checks. Prospective drivers indispensable taxable a Social Security number, afloat name, day of birth, government-issued recognition and a unrecorded illustration photograph earlier being approved to drive.

Eva Velasquez, president and CEO of the Identity Theft Resource Center, said cases similar Tatoosi's are an illustration of employment individuality theft, a increasing occupation nationwide.

"This is simply a signifier of employment individuality theft oregon misuse," Velasquez said. "We person to recognize that our information is retired there. It's successful the wild."

Velasquez said the emergence of distant and app-based enactment has made it easier for criminals to impersonate others, particularly erstwhile employers and workers ne'er conscionable successful person.

One of the taxation forms Vahik Tatoosi received claimed helium had allegedly earned astir $7,000 portion moving for Uber.

CBS LA

One of the taxation forms Vahik Tatoosi received claimed helium had allegedly earned astir $7,000 portion moving for Uber.

CBS LA

"Your Social Security fig and different idiosyncratic accusation tin beryllium utilized for employment purposes," she said. "That's surely the lawsuit with Uber."

The contented has surfaced successful different cases. In 2024, a Kern County antheral sued Uber aft receiving a taxation signifier showing $53,000 successful net from the company, contempt ne'er having worked for it. The suit alleged it took a twelvemonth to resoluteness the substance with the IRS and claimed Uber "routinely allows individuals to enactment for it arsenic a rideshare oregon transportation operator utilizing the idiosyncratic accusation of different individuals."

Uber declined a CBS LA petition for an on-camera interrogation but said successful a connection that it has escalated Tatoosi's complaint.

"The methods of scamming and defrauding companies are perpetually evolving," the institution said. "At Uber, we're committed to investing successful robust anti-fraud systems and detection capabilities to support up with caller and enhanced fraud techniques."

The Identity Theft Resource Center recommends that consumers get an IRS individuality extortion PIN, make a "my Social Security" relationship with the Social Security Administration and show it regularly. Anyone who believes they are a unfortunate of employment fraud should instantly interaction the IRS and record a fraud report.

Tatoosi and his woman said they person frozen their recognition and enrolled successful a credit-monitoring service. They are present moving with the IRS to code the fraudulent income reported nether Tatoosi's name.

"The income is being reported nether our name," Kojoyan said. "Now we person to interaction the IRS and fto them cognize what's going on, due to the fact that they're going to expect america to wage taxes connected it."

Uber said it uses a multi-level fraud detection process and re-screens drivers annually.

California antheral says helium learned his individuality was stolen aft receiving taxation forms for wealth helium didn't

California antheral says helium learned his individuality was stolen aft receiving taxation forms for wealth helium didn't

(03:58)

3 days ago

12

3 days ago

12

English (US) ·

English (US) ·